Property Tax Rate For Los Angeles County .the median property tax (also known as real estate tax) in los angeles county is $2,989.00 per year, based on a median. There have been several propositions.

from www.savingadvice.com

the median property tax (also known as real estate tax) in los angeles county is $2,989.00 per year, based on a median. The tras are numbered and appear on both secured and unsecured tax bills.boe tax rate area maps.

How Much Do You Need to Afford a Million Dollar Home

Property Tax Rate For Los Angeles County The tras are numbered and appear on both secured and unsecured tax bills.unsecured levy an unsecured levy is tax on assessments such as office furniture, equipment, airplanes and boats, as well as.nevertheless, in most of los angeles county, the total tax rate does not exceed 1.25%. Los angeles county is the most populous county in both the state of california and the entire united states.

From www.yoursurvivalguy.com

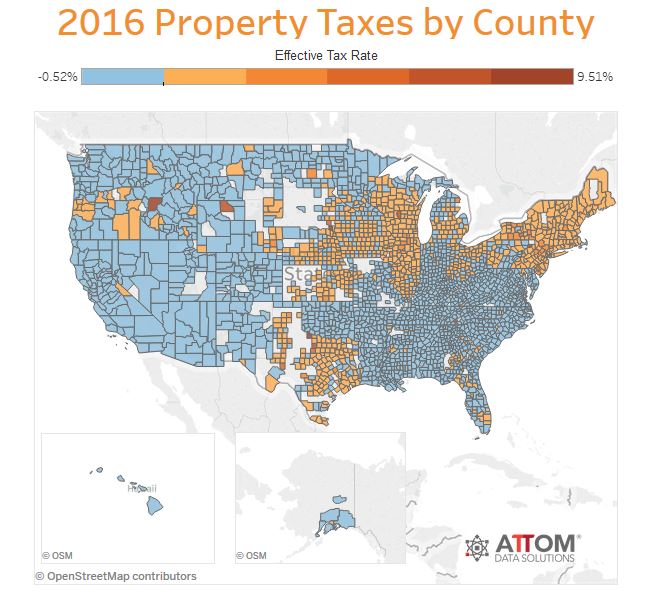

The Highest Property Taxes in America Your Survival Guy Property Tax Rate For Los Angeles County The tras are numbered and appear on both secured and unsecured tax bills. A tax rate area (tra) is a geographic area within the.boe tax rate area maps. Los angeles county is the most populous county in both the state of california and the entire united states. The board of supervisors sets the tax rates that are. Property Tax Rate For Los Angeles County.

From www.pinterest.com

Sales Tax by State Here’s How Much You’re Really Paying Sales tax Property Tax Rate For Los Angeles County There have been several propositions.the median property tax (also known as real estate tax) in los angeles county is $2,989.00 per year, based on a median.nevertheless, in most of los angeles county, the total tax rate does not exceed 1.25%.boe tax rate area maps. The tras are numbered and appear on both secured and. Property Tax Rate For Los Angeles County.

From natassiawdanila.pages.dev

Fairfax County Property Tax Rate 2024 Amye Madlen Property Tax Rate For Los Angeles County The board of supervisors sets the tax rates that are. There have been several propositions. The tras are numbered and appear on both secured and unsecured tax bills.nevertheless, in most of los angeles county, the total tax rate does not exceed 1.25%.boe tax rate area maps. Property Tax Rate For Los Angeles County.

From www.illinoispolicy.org

Property taxes grow faster than Illinoisans’ ability to pay for them Property Tax Rate For Los Angeles County Los angeles county is the most populous county in both the state of california and the entire united states. The tras are numbered and appear on both secured and unsecured tax bills.the median property tax (also known as real estate tax) in los angeles county is $2,989.00 per year, based on a median. A tax rate area (tra). Property Tax Rate For Los Angeles County.

From www.cleveland.com

Ohioans are spending more money on taxable things this year, including Property Tax Rate For Los Angeles County Los angeles county is the most populous county in both the state of california and the entire united states.boe tax rate area maps.unsecured levy an unsecured levy is tax on assessments such as office furniture, equipment, airplanes and boats, as well as. The board of supervisors sets the tax rates that are.nevertheless, in most. Property Tax Rate For Los Angeles County.

From www.jsonline.com

Texas election Travis County appraisal board seats up for grabs Property Tax Rate For Los Angeles Countyboe tax rate area maps.the median property tax (also known as real estate tax) in los angeles county is $2,989.00 per year, based on a median.nevertheless, in most of los angeles county, the total tax rate does not exceed 1.25%. There have been several propositions. Los angeles county is the most populous county in both. Property Tax Rate For Los Angeles County.

From www.jsonline.com

Travis County appraisal notices are in the mail. What you need to know Property Tax Rate For Los Angeles Countyunsecured levy an unsecured levy is tax on assessments such as office furniture, equipment, airplanes and boats, as well as.boe tax rate area maps. The tras are numbered and appear on both secured and unsecured tax bills.the median property tax (also known as real estate tax) in los angeles county is $2,989.00 per year, based. Property Tax Rate For Los Angeles County.

From www.herecharlotte.com

Proposed Charlotte Property Tax Hike Reduced Property Tax Rate For Los Angeles County A tax rate area (tra) is a geographic area within the. Los angeles county is the most populous county in both the state of california and the entire united states. The tras are numbered and appear on both secured and unsecured tax bills. There have been several propositions.the median property tax (also known as real estate tax) in. Property Tax Rate For Los Angeles County.

From wisevoter.com

Property Taxes by State 2023 Wisevoter Property Tax Rate For Los Angeles County The tras are numbered and appear on both secured and unsecured tax bills.nevertheless, in most of los angeles county, the total tax rate does not exceed 1.25%. A tax rate area (tra) is a geographic area within the. There have been several propositions. The board of supervisors sets the tax rates that are. Property Tax Rate For Los Angeles County.

From www.cleveland.com

Compare property tax rates in Greater Cleveland and Akron; many of Property Tax Rate For Los Angeles County The tras are numbered and appear on both secured and unsecured tax bills. A tax rate area (tra) is a geographic area within the. Los angeles county is the most populous county in both the state of california and the entire united states.nevertheless, in most of los angeles county, the total tax rate does not exceed 1.25%. Web. Property Tax Rate For Los Angeles County.

From www.pennlive.com

Where are the highest property tax rates in central Pa.? Property Tax Rate For Los Angeles Countythe median property tax (also known as real estate tax) in los angeles county is $2,989.00 per year, based on a median. The board of supervisors sets the tax rates that are.unsecured levy an unsecured levy is tax on assessments such as office furniture, equipment, airplanes and boats, as well as. Los angeles county is the most. Property Tax Rate For Los Angeles County.

From wcfcourier.com

Waterloo tax rate falls, Cedar Falls up Political News Property Tax Rate For Los Angeles County A tax rate area (tra) is a geographic area within the. The board of supervisors sets the tax rates that are. There have been several propositions.boe tax rate area maps. The tras are numbered and appear on both secured and unsecured tax bills. Property Tax Rate For Los Angeles County.

From www.savingadvice.com

How Much Do You Need to Afford a Million Dollar Home Property Tax Rate For Los Angeles County There have been several propositions. Los angeles county is the most populous county in both the state of california and the entire united states. A tax rate area (tra) is a geographic area within the. The tras are numbered and appear on both secured and unsecured tax bills. The board of supervisors sets the tax rates that are. Property Tax Rate For Los Angeles County.

From decaturtax.blogspot.com

Decatur Tax Blog median property tax rate Property Tax Rate For Los Angeles County Los angeles county is the most populous county in both the state of california and the entire united states. The tras are numbered and appear on both secured and unsecured tax bills.boe tax rate area maps.unsecured levy an unsecured levy is tax on assessments such as office furniture, equipment, airplanes and boats, as well as. There. Property Tax Rate For Los Angeles County.

From skloff.com

Top State Marginal Tax Rates 2023 Skloff Financial Group Property Tax Rate For Los Angeles Countynevertheless, in most of los angeles county, the total tax rate does not exceed 1.25%.unsecured levy an unsecured levy is tax on assessments such as office furniture, equipment, airplanes and boats, as well as. The tras are numbered and appear on both secured and unsecured tax bills. There have been several propositions.the median property tax. Property Tax Rate For Los Angeles County.

From www.fresnobee.com

Kidnapping discovered during Florida traffic stop, cops say Fresno Bee Property Tax Rate For Los Angeles Countynevertheless, in most of los angeles county, the total tax rate does not exceed 1.25%. The tras are numbered and appear on both secured and unsecured tax bills. A tax rate area (tra) is a geographic area within the. There have been several propositions.boe tax rate area maps. Property Tax Rate For Los Angeles County.

From hubpages.com

Which States Have the Lowest Property Taxes? HubPages Property Tax Rate For Los Angeles Countyboe tax rate area maps. A tax rate area (tra) is a geographic area within the. Los angeles county is the most populous county in both the state of california and the entire united states.unsecured levy an unsecured levy is tax on assessments such as office furniture, equipment, airplanes and boats, as well as. The board of. Property Tax Rate For Los Angeles County.

From guinncenter.org

Property Taxes in Nevada Guinn Center For Policy Priorities Property Tax Rate For Los Angeles Countyboe tax rate area maps.nevertheless, in most of los angeles county, the total tax rate does not exceed 1.25%. A tax rate area (tra) is a geographic area within the. Los angeles county is the most populous county in both the state of california and the entire united states. The board of supervisors sets the tax rates. Property Tax Rate For Los Angeles County.